Increasingly potent and frequent wildfires in Canada have contributed to skyrocketing home insurance premiums in areas of high risk, adding another affordability challenge for homeowners, an analysis by Wahi and MyChoice found.

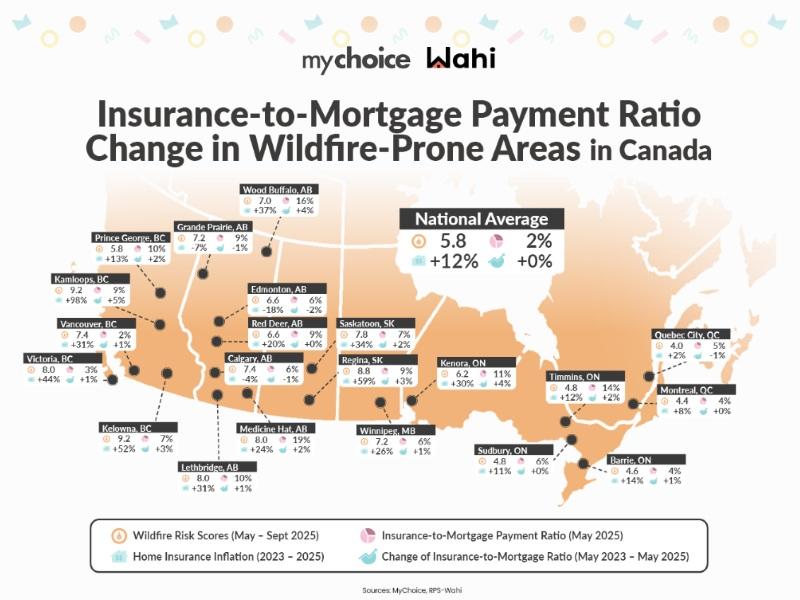

The teams at the two companies examined how home insurance premiums have changed between 2023 to 2025 in 21 cities and municipalities with the highest risk of wildfires, and whether those rising costs are impacting housing affordability.

The highest home insurance inflation during the period was seen in Kamloops, Regina and Kelowna, cities with the highest wildfire risk scores on the list. For example, premiums nearly doubled in Kamloops over the two-year period to $3,743.

“We’re getting to the point where this insurance risk is comparable, in many places, to the cost of buying the property,” Ryan McLaughlin, an economist at Wahi, said in an interview with RENX Homes.

The data shows the impact that insurance has on housing affordability, and how a warming climate must be factored into the conversation, he said.

Where premiums rose the most

To create the report, thousands of homeowner quotes were generated through insurance rate aggregator MyChoice between January and June 2025, and compared to the same period in 2023. The analysis focused on quotes that reflect a typical homeowner and also drew upon Wahi’s home value estimate data.

Wahi and MyChoice calculated the monthly insurance-to-mortgage payment ratio per city or municipality, and the average home insurance premiums. This gave an idea of how rising premiums are affecting monthly budgets.

Across Canada, average home insurance premiums rose by 12 per cent from 2023 to 2025 — $933 to $1,043. The average Canadian homeowner was found to spend approximately two per cent of their mortgage payment on home insurance.

The analysis uncovered a considerable difference between the national average and Canada’s cities that face high risk of wildfire. It also found that the higher the wildfire risk, the higher the insurance premium inflation, McLaughlin said.

After Kamloops, the second-highest premium increase by percentage was in Regina, which went up 59 per cent — from $1,231 to $1,957. The monthly insurance-to-mortgage payment ratio jumped from six per cent to nine per cent.

Wood Buffalo, Alta., a municipality that includes Fort McMurray, saw premiums leap by 37 per cent to $3,367. Insurance costs now make up 16 per cent of the average mortgage payment in the area.

Medicine Hat, Alta. was called “the least affordable market for insurance,” by MyChoice. Premiums in the city rose by 24 per cent from 2023 to 2025, reaching $3,875. Monthly insurance payments in Medicine Hat are an average of 19 per cent of a typical mortgage, highest among all cities in the report.

Edmonton, Calgary saw premiums decrease

The news was not all bad, however.

While Alberta was one of the provinces with the sharpest premium appreciations, its biggest cities saw insurance costs decline over the two-year period.

Calgary, for example, saw home insurance deflation of four per cent to $2,345 in 2025. In Edmonton, premiums fell by 18 per cent to $1,725 as of 2025. This is despite both cities having a higher wildfire risk score than the national average.

McLaughlin speculates it has to do with insurance companies determining the risk levels are “just not as high.” He also believes additional insurance companies might have entered the city's markets and added competitive pressure to lower prices.

Climate change affects housing affordability

While there are many causes of Canada’s high housing costs, McLauglin said rising wildfire risk premiums cannot be ignored.

“It’s an underrated cost factor for shelter . . . This is a driver of unaffordability.”

If the costs of insuring housing continue to escalate, MyChoice says it could influence where Canadians live. If insurance payments make up 15 to 20 per cent of mortgage bills, home ownership will become even less accessible.

There's another concern, too: If insurers cannot charge premiums that match the risk or the premiums become unaffordable, insurance companies may decide to exit markets, leaving behind homes that cannot be insured.

“Climate change is driving a very direct consequence in terms of affordability” across Canadian cities, McLaughlin said.

The Insurance Bureau of Canada attributes rising insurance premiums in Canada’s property market to high inflation and increasingly severe weather events. Last year set a record for severe weather-related losses in Canada at $8.5 billion in insured damages. Scientists have connected global warming to more powerful wildfires, storms and floods.

To address the problem, MyChoice recommends better forest management and updated building codes, and for homeowners to better protect their properties against wildfires. Governments may need to insure areas where the private sector has vacated.

“We have to reduce our greenhouse gas emissions, but there might be other things to be thought about as well,” McLaughlin said.